Drink up! It's free, and Dave Berry has been handing it out without restraint in Georgia recently. Full disclosure: this post is long and nerdy. I am completely convinced that no normal person would want to read this stuff.

Introduction

Many of you are aware: Clean Line (and all of us, unfortunately) has a long road ahead of them with their "Plains and Eastern" project. Landowners oppose the project in record numbers, the entire Arkansas federal congressional delegation supports us (thank you!), and they have quite a few hurdles to jump before any shovels hit the ground. After the Department of Energy's recent approval, one of the biggest hurdles Clean Line has to jump over is obtaining customers. Not "letters of intent" or the like, but REAL, firm, and enforceable contracts for capacity on their line.

They need customers, customers, customers... like, yesterday. Customers are the butter for their bread. Without them, they can't use eminent domain against us, the DOE won't help them with landowner negotiations, they can't get financing, the line becomes financially unfeasible, and it doesn't get built. Period. As frustrating as it is... in this case, time is our friend.

These things being said, I would just like to say that being as immersed as we have been in this process and opposition for going on three years now, it is a spectacular emotional (and physical) roller coaster. There is constant worry, and you're always trying to find something, anything, to ease your mind a bit. If there's anything we've learned about Clean Line, there are two sides to them: There is the public, rosy aura that they want you to perceive, and then there are the things that are going on behind the scenes to accomplish their goals. Sometimes it takes a bit of digging to get the full picture. I hope you enjoy.

Clean Line Needs Customers

Really, Clean Line has just has about three options when it comes to subscription:

- Large utilities such as the TVA, Southern Company and it's subsidiaries, Entergy Arkansas/Louisiana, etc, can buy large chunks of their capacity. One would have to assume that this option would be preferable to CLEP because it is the easiest for them.

- Smaller municipal electricity co-ops throughout the "midsouth and southeast" can sign much smaller capacity contracts in the 25-50mW range. It takes a LOT of those to fill the capacity of a 4,000mW line.

- There are some corporations that want to "green" their image. Imagine the scenario where a few private, for-profit "Fortune 500" companies are alright with other another private, for-profit company seizing land from private landowners to aid in their quest to make themselves look good. Yeah, that's the point we've gotten to in this country. Here's evidence:

Enjoy your Corn Flakes, folks!

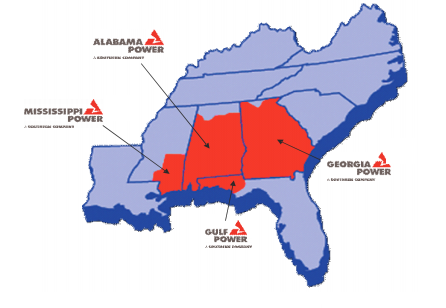

One of the potential customers Clean Line has been courting (or attempting to strong-arm, depending on your perspective) is Georgia Power (GP). Now, for a little bit of clarity and perspective, GP is a subsidiary of Southern Company, and here is their service territory:

According to Wikipedia:

Georgia Power is an electric utility headquartered in Atlanta, Georgia, United States. It was established as the Georgia Railway and Power Company and began operations in 1902 running streetcars in Atlanta as a successor to the Atlanta Consolidated Street Railway Company.

Georgia Power is the largest of the four electric utilities that are owned and operated by Southern Company. Georgia Power is an investor-owned, tax-paying public utility that serves more than 2.25 million customers in all but four of Georgia's 159 counties. It employs approximately 9,000 workers throughout the state.

The Georgia Power Building, its primary corporate office building, is located at 241 Ralph McGill Boulevard in downtown Atlanta.

Unlike Clean Line, they're a serious utility, much like Entergy within the state of Arkansas. They're also leading the way in the southeast for emissions reductions, apparently now without Clean Line. Why do I say this? Let me explain:

Back in January, Georgia Power released their latest proposed Integrated Resource Plan (IRP), in which they lay out their generation requirements for the next twenty years. Here's the full docket. Where Clean Line enters this IRP mix is directly tied to their "REDI" program which is nested within their broader IRP on page 10-106:

Back in January, Georgia Power released their latest proposed Integrated Resource Plan (IRP), in which they lay out their generation requirements for the next twenty years. Here's the full docket. Where Clean Line enters this IRP mix is directly tied to their "REDI" program which is nested within their broader IRP on page 10-106:

As part of its continued effort to responsibly grow the renewable generation market in Georgia and provide energy benefits to all customers, the Company is proposing the procurement of an additional 525 MW of renewable capacity through 2019 if such procurement can be obtained below the Company’s projected avoided costs. In order to provide the maximum amount of benefit to customers, the Company is proposing to procure this energy through three distinct programs: (1) RFPs from renewable developers with utility scale projects to fulfill an annual portfolio capacity target; (2) RFPs from developers with smaller, distributed scale projects to fulfill an annual portfolio capacity; and, (3) smaller, distributed scale solar purchase offerings from Georgia Power customer-sited projects.Where Clean Line's part would come in:

Under the utility scale portion of the REDI RFPs, Georgia Power proposes to purchase energy from up to 425 MW of renewable generation scheduled to achieve commercial operation no later than December 31, 2019. The Company will file a detailed RFP schedule in September 2016 that will outline the timeline for the 425 MW RFP. The Company will accept proposals for solar, wind, and biomass projects with 2018 or 2019 commercial operation dates (“COD”) based on transmission impacts and overall value. The Company will take ownership of all Renewable Energy Credits (“RECs”) produced by these facilities. Third-party proposals that allow for Georgia Power ownership will be considered.

For utility scale resource bids, the Company will accept proposals for projects that are greater than 3 MW in size, but no larger than 210 MW in size that can attain commercial operation in 2018. The Company will also accept proposals for projects greater than 3 MW in size but no larger than 215 MW in size that can attain commercial operation in 2019. Consistent with the ASI-Prime utility scale RFP, the PPAs will be for a term of up to 30 years.

For all renewable resources bids, the Company will accept both “as delivered” proposals and “firm block” proposals. The cost of upgrades on Southern Company’s electric system to deliver to Southern Balancing Authority Area load, if required, will be imputed into the total bid costs.That sounds good for Clean Line, right? Georgia Power accepting proposals from HVDC would be a great thing for them. There's only one problem with it: Those pesky in-service dates. See, Clean Line is pushing the idea that their transmission line will be energized by 2020. My opinion is, even if everything goes exactly as planned for them, there's less than a snowball's chance of that, but that's another post entirely (I think GP knows that, too). The problem with GP's IRP for Clean Line revolves around their proposed "Request for Proposals" (RFP). In the original IRP, the RFP is laid out to be executed as follows:

However, for renewable resources located outside of the Southern Balancing Authority Area, proposals must bear all transmission delivery cost and risk to the point of delivery at the Southern Balancing Authority Area interface. The Company will accept proposals for delivery to the Southern Balancing Authority Area interface across high voltage direct current (“HVDC”) lines.

For utility scale resource bids, the Company will accept proposals for projects that are greater than 3 MW in size, but no larger than 210 MW in size that can attain commercial operation in 2018. The Company will also accept proposals for projects greater than 3 MW in size but no larger than 215 MW in size that can attain commercial operation in 2019. Consistent with the ASI-Prime utility scale RFP, the PPAs will be for a term of up to 30 years.

Clean Line really wants Georgia Power as a transmission customer. REALLY wants them. Where the "Clean Line whine" enters the picture is with their own David Berry's intervention into the docket to approve Georgia Power's 2016 IRP. See, Clean Line wants everyone in the southeast to have renewable energy as quickly as possible, unless it's not Clean Line's renewable energy. When it turns out that it might not be Clean Line's renewable energy that will enter Georgia Power's mix via their REDI program, they send one of their top guys to try to get the Georgia PSC to maybe persuade GP to change their IRP a little bit to help them out:

- Authorize and direct the procurement of additional renewables beyond the 525

MW currently identified in the IRP so long as the resources are below Georgia

Power’s avoided cost. Georgia Power currently proposes initiating a Renewable

Energy Development Initiative (“REDI”), which includes plans to procure an

additional 525 MW of renewable capacity through a REDI Request for Proposal

(“RFP”). As identified in the IRP on page 10-104, Table 2: Components by

Resource Type- Wind & Biomass, integrating wind resources results in significant

benefits due to avoided fuel and purchased power costs, avoided operations and

maintenance costs, avoided environmental compliance costs, and avoided

capacity costs. The Commission should authorize and direct Georgia Power to

procure more than 525 MW of renewables if additional proposals are received

that have a higher benefit to Georgia Power ratepayers than cost, which will result

in downward pressure in rates.

- Maintain the RFP’s flexibility across technologies. Renewable energy

technologies, particularly wind and solar, are complementary resources. Wind

energy is typically the lowest cost resource, produces more energy per megawatt

(“MW”) installed, contributes substantially to meeting winter peak demand and

provides for economic development opportunities in the supply chain. Solar

energy contributes substantially to meeting summer peak demand and provides for local construction job opportunities. The two resources also complement one

another on a time of day basis, and a portfolio of both wind and solar produces

less system variability. By increasing the size of the RFP, there will be substantial

opportunities to include both cost-effective wind and solar generation into

Georgia Power’s supply portfolio.

- Accelerate the timing of the RFP to align with the wind Production Tax Credit

phase out, resulting in lower costs of wind generation. The REDI RFP should

begin as soon as possible to ensure that the wind proposals received capture the

full value of the Production Tax Credit (“PTC”). 2016 will be the last year that

new wind project construction will be eligible for the full value of the PTC. Wind

generators can preserve this value by incurring 5% of the total cost, or starting

construction, of the facility during 2016. However, without firm commercial

commitments from Georgia Power, wind generation companies are unlikely to

invest the significant capital needed to qualify wind farms for the full PTC value

in order to supply the lowest cost wind power. Delaying the start of the RFP until

late this year, or until 2017, will result in wind generation proposals that are more

expensive due to a lower PTC value.

- Allow proposals commencing operations as late as 2021 if they offer higher net

benefits to customers. The current construct of the RFP proposes procuring 210

MW of utility scale renewable projects that can attain commercial operation in

2018 and 215 MW of utility scale renewable projects that can attain commercial

operation in 2019. This does not provide sufficient time for wind generators using

Plains & Eastern or other new transmission lines to come online. Clean Line

believes that the lowest-cost renewable resource available to Georgia Power is

Oklahoma Panhandle wind power delivered via Plains & Eastern, which will

begin delivering energy to the Southeast in 2020. Closing the RFP to such a

resource would likely increase costs for Georgia Power customers.

- Encourage Georgia Power to evaluate ownership of wind assets. Finally, the RFP should consider the additional benefits to ratepayers if Georgia Power were to own the wind facilities. Clean Line supports the following statement from pg. 10- 106 of the IRP: “third-party proposals that allow for Georgia Power ownership will be considered.” Investments in wind will likely result in a lower delivered cost of energy than the same resource procured via a power purchase agreement, due to Georgia Power’s low cost of capital and efficient use of tax credits.

Also:

Q. Please explain how specifying required online dates may limit the responses received in the REDI RFP

A. The current construct of the RFP proposes procuring 210 MW of utility scale renewable projects that can attain commercial operation in 2018 and 215 MW of utility scale renewable projects that can attain commercial operation in 2019. The lowest cost wind resource available to Georgia Power is likely to be Oklahoma Panhandle wind delivered via Plains & Eastern, which will begin delivering energy to the Southeast in 2020. Clean Line plans to allocate a majority of the 4,000 MW of transmission capacity to the Southeast to generator-shippers in 2016 and early 2017. This finite resource will not be available if Georgia Power waits until the next IRP cycle in 2019 to evaluate delivered Plains & Eastern wind, and maintaining a 2018 or 2019 required online date may preclude these resources from competing in the proposed REDI RFP.

It would be incredibly convenient for Clean Line if the Georgia PSC directed Georgia Power to adopt these recommendations, wouldn't it?

So, did Mr. Berry get what he wanted? It doesn't appear like he will. Georgia Power did, in fact, increase the amount of renewable energy they'd procure. It also appears that they added a stipulation that only 300mW of energy procured through REDI could be wind. That doesn't help. Did they bend their RFP dates for the sole benefit of including Clean Line? No. Did they say they would consider projects with an in-service date in 2020-2021 in their 2017 RFP? No. Doesn't do a lot to help them:

3. The Renewable Energy Development Initiative ("REDI") is approved and shall be increased such that it will procure 1,200 MW (150 MW of Distributed Generation ("DG") and 1,050 MW of utility scale resources.) Utility scale procurement shall take place through two separate Requests For Proposals ("RFP"). The first RFP will be issued to the marketplace in 2016 and will seek 525 MW of renewables with in service dates of 2018 and 2019. The second RFP will be issued to the marketplace in 2019 and will seek 525 MW of renewables with in service dates of 2020 and 2021. No more than a total of 300 MW of wind resources shall be procured through REDI...Conclusion: There's a good chance we can cross out Georgia Power from Clean Line's list of potential customers (at least until 2019). It's good news.

Time Is Our Friend

Mr. Berry outlines perfectly on page 19 the reason their project's success is related directly to the Production Tax Credit (PTC). Any pesky delays from landowners or other entities makes their project increasingly less financially feasible as the clock ticks:

V. The REDI RFP should begin as soon as possible, and should allow proposals for delivery later than 2018.

Q. How will the timing of the REDI RFP affect the wind prices that are received?

A. The timing of the RFP will have a large effect on the wind proposals received, as the Production Tax Credit will begin a multi-year phase out in 2017. The Consolidated Appropriations Act of 2015 extended the Section 45 PTC for electricity produced from wind generation retroactively to January 1, 2015, and prospectively through the end of 2019. After 2016, the credit will be reduced by 20% for projects that begin construction in 2017, by 40% for projects that begin construction in 2018, and by 60% for projects that begin in 2019. The wind PTC would expire for projects that begin construction on or after January 1, 2020.

Under guidance previously issued by the IRS interpreting the “beginning of construction” rule for qualified renewable power facilities there are two methods that a taxpayer may use to establish that construction of a qualified facility has begun:

1. A taxpayer may establish the beginning of construction by: (a) starting physical work of a significant nature (Physical Work Test) and (b) thereafter maintaining a continuous program of construction.

2. Under the second method, a taxpayer may establish the beginning of construction by meeting the so-called “5% safe harbor,” which provides that construction of a facility will be considered as having begun if (1) a taxpayer pays or incurs five percent or more of the total cost of the facility before the applicable expiration date, and (2) thereafter, the taxpayer makes continuous efforts to advance towards completion of the facility.

Wind generators need certainty of offtake arrangements prior to incurring five percent of the total cost of the facility or commencing construction. Georgia Power currently plans to file a detailed RFP schedule with the Commission in September 2016, which would lead to the issuance of the RFP likely in early 2017. This timing would eliminate the potential for wind proposals that include the full value of the PTC. Georgia Power should release the RFP as soon as possible.

This declining PTC value means that the lowest cost wind will be procured in 2016, and the cost of wind energy will rise between 2016 and 2020 as the tax credit is phased out. Improvements in wind turbine technology have significantly increased the capacity factor of wind, thereby lowering the delivered cost of energy, but near-term improvements in turbine technology will not be sufficient to compensate for this lost PTC value.

Thanks for that description, Mr. Berry. I haven't been able to find a better one anywhere else.

Plains and Eastern is Not "Clean" Anymore

Not only that, but David Berry also admits something that we've known all along, but Clean Line says nothing about: Clean Line is no longer a "clean" line anymore, either. This is found on page 13 of the testimony linked at the top of this section:

Q: Are there any additional value components associated with transmission service across Plains & Eastern that should be evaluated during the renewable RFP process?So, translation: As we all know, the wind doesn't blow all the time. What Mr. Berry is saying here is that, when wind generation isn't supplying full capacity on the line, that extra available capacity could very well be filled with coal-generated power from the bulk SPP system. While Clean Line has been portraying this line as the "green" way to go, it turns out that isn't the whole truth. Who would have thought, right? All of us.

A. Yes. In addition to transferring low cost wind, transmission capacity on Plains & Eastern can be used to deliver bulk power from the SPP system during the hours when wind generation is not using the entire capacity of Plains & Eastern. Clean Line has estimated that the ability to deliver SPP market power could save Georgia ratepayers approximately $9 million dollars a year. This calculation assumes that Georgia Power or a wind generator has obtained enough transmission service across Plains & Eastern to deliver 1000 MW to the Southern system.

What say you Glen Hooks and Bob Allen?

Conclusions

- Clean Line needs customers, they seem borderline desperate, and Georgia Power is not likely to be one of those customers anytime soon.

- In this case, time is our friend.

- The Plains and Eastern "clean line" isn't quite as clean as it has been portrayed. It's turning into a regular old transmission line.

If you made it this far, thanks for reading! :)