For mobile users, I apologize for the formatting irregularities. Orienting your phone horizontally should fix them.

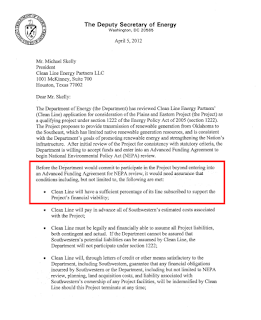

Before the Department of Energy agreed to enter into their Advanced Funding Agreement with Clean Line, acting Deputy Secretary Daniel Poneman wrote a letter to Michael Skelly laying out the criteria Clean Line would have to meet to further the partnership.

Clean Line has NO subscription. Not a single megawatt. Zilch. Nada. The Tennessee Valley Authority has indicated that it doesn't want any sort of HVDC wind until 2025 or later (but only if all proverbial stars align):

Unless something drastic changes in the next month (I don't think it will) before the TVA Board of Directors votes on the adoption of their 2015 Integrated resource plan, it appears the graphics above illustrate the near-term plan for TVA. No HVDC for TVA for at least 10 years.

Clean Line has recently tried to downplay TVA's importance to their business plan, even though the entire reason for the project from the beginning has been to deliver wind energy to the TVA:

Michael Skelly, president and founder of Clean Line Energy, said Thursday that TVA is just one of several utilities that seeks wind-generated power. One of those is The Southern Company, which provides power to 4.4 million customers in Mississippi, Alabama, Georgia and Florida.

“The market is much larger than TVA,” Skelly said.

So, I did a little more research on Georgia Power (a subsidiary of Southern Company). Georgia power is one of the other companies Clean Line would love to sign on with. This is going to be long, but for the Clean Line nerds among us, all of it is well worth a read. Seriously, if you have any serious interest in the future of this at all, read both of the following things and the documents in the provided links line-by-line. The following are just a few small excerpts of the analysis Georgia Power did on out-of-state wind purchases. On December 4, 2014, Georgia Power issued an RFP for wind energy. This is a summary of their findings, specifically regarding HVDC (emphasis added):

5.2 HVDC Project Impact. Five responders submitted proposals into the RFI that depend upon transmitting over a proposed HVDC line (the “HVDC Project”), which would facilitate delivery from the Texas/Oklahoma panhandle into the TVA Control Area. The use of this HVDC line has the potential to eliminate delivery risk across the SPP and MISO Transmission Systems. The HVDC Project referenced in these proposals is currently in the development stage with construction planned to begin in 2016 and is estimated to be in service by the end of 2018.And:

The proposed projects that rely on the HVDC solution are not without concern. Several of these projects were noted as being PTC dependent. Therefore, even if the wind projects were to come online before 2018, the proposed energy could not be delivered to Georgia Power customers until the HVDC line is in service. Any delay in the construction date of the HVDC line will likely affect the ability of these projects to take advantage of the PTC. In addition, transmission rights along the HVDC line have not been awarded, nor has pricing for the transmission rights been established. This calls into question the accuracy and validity of all proposals assuming that the wind resource will be transmitted to Georgia Power through the HVDC line.

6.2 Net Benefits. As a result of the Company’s thorough review of the proposals, Georgia Power calculated potential total net benefits ranging from -$13.58/MWh to $24.31/MWh on a levelized basis. The indicative nature of an RFI suggests that net benefits are overstated, and more likely substantially overstated, as discussed further in the section below on risk.

6.3 Risks. Although the evaluations of the RFI responses forecasted net benefits for some proposals, the appropriate risk and contingency factors must be imputed to these results to get a clear picture of the actual value of the proposals. The total net benefit results are a direct reflection of quality of the inputs and the current assumptions included in the Company’s transmission base cases. Changes to the following assumptions and considerations could have a material impact on the previously noted net benefit valuations:

- The responses provided by developers are non-binding. As a result, respondents shoulder no risk in offering products that are unrealistic in terms of low prices, aggressive schedules, and excessive energy amounts.

- The pricing offered by developers was provided in a context outside the specific terms and conditions of a PPA. The contractual language within a PPA is a large driver in determining the allocation of risk and consideration within a transaction and results in transaction-specific pricing.

- Georgia Power assigned delivery costs based upon current market assumptions for projects offered at the busbar or delivered outside of the SBA. However, the recent merger of the Entergy and MISO transmission systems has created tremendous volatility in neighboring markets. In fact, the cost of firm transmission service through SPP and MISO has increased, by 65 percent and 100 percent respectively, in the past four years. While Georgia Power’s evaluation relied on the latest publicly available information, the current forecast calls for more moderate and stabilizing conditions, which is a very different environment from experiences in the past few years.

- The transmission costs assigned to accommodate additional imports across the SOCO interfaces are based upon the most current base case assumptions. These assumptions reflect commitments by entities external to Southern Company and were developed in a coordinated manner through the SERC and ERAG base case building process. The results provided in this Report are based upon the current conditions, but are subject to change based upon re-evaluations that are regularly performed in accordance with NERC planning and transfer capability guidelines.

In addition, there was this:

- Five responses depended on a speculative HVDC transmission solution. Any potential net benefits from these proposals are highly questionable because the transmission rights along the line have not been awarded, nor has the pricing for transmission rights been finalized.

With regard to the Clean Power Plan (CPP), Staff Consultants assert that “procuring wind will likely be a method of compliance for the Company to meet Georgia’s goal under the clean power plan.” La Capra Associates Wind Request for Information Review (May 19, 2015), pg 3 (hereinafter “La Capra Report”). Yet no one knows how federal law will view out-of-state wind for CPP compliance purpose, until that issue is addressed in the final rule. Even if out-of-state wind is addressed, the final rule may be stayed and will most likely be litigated, so uncertainty will remain until Georgia’s CPP state or regional compliance plan is developed and approved a few years from now.

It is unnecessarily risky to issue an RFP for out-of-state wind as a compliance option for the CPP without the certainty it will be an actual option for compliance. Without knowing the rules and requirements for how that option will be treated, it would be premature to issue an RFP now. Additionally, if out-of-state wind can serve as a CPP compliance option, it will only mean that a wind purchase would be considered as one item on the collective list of compliance options. It is unnecessarily risky and possibly costly to unilaterally select wind to meet compliance requirements without first giving due consideration to the best mix of resources and options to achieve CPP compliance.And:

As stated previously, the Wind RFI Report shows there are significant limitations to procuring out-of-state wind products that will require system upgrades and additional costs for customers. The Staff Consultant does not contest this finding. Instead, Staff and its Consultant believe it is better to enter into non-firm transmission deals. However, reliance on non-firm wind opportunities introduces significant risks and cost concerns that undermine potential customer benefits from added wind resources. The La Capra Report states “that it may not be necessary for wind projects to have firm transmission to create benefits for ratepayers.” La Capra Report, pg 3. The Company disagrees. It is inappropriate to issue an RFP based upon conjecture. The marketplace trusts that when Georgia Power issues an RFP, the Company intends to procure new resources. To go fish for potential non-firm energy deals that may actually reduce the benefits to customers and then not proceed with contract execution undermines Georgia Power’s position in the marketplace. Furthermore, importing wind provides significant cost risk to customers, especially if such imports are of a non-firm nature, as Staff recommends. The benefits that non-firm transmission wind products would provide Georgia Power customers may be completely eliminated if customers take on the risk of operation and transmission costs for delivery. Further, Georgia Power will need to know with certainty what wind products it is purchasing and when such products will be delivered if it intends to use such wind resources for CPP compliance purposes. If Staff and its Consultant believe that it is more beneficial to customers to procure non-firm wind products, they should present testimony on that position in the IRP proceeding.

In conclusion, the value at which Georgia Power could procure out-of-state wind over the next 12 to 18 months cannot be predicted with any real level of certainty. There are significant risk factors that could weigh against the perceived value of additional wind resources. Most importantly, no record exists that supports a conclusion that the Commission must move hastily or that additional out-of-state wind is the right option for Georgia Power’s customers. The required record to make an informed decision on additional wind resources may be developed in the 2016 IRP. As always, the Company will continue to work with Staff and Interveners to ensure customers receive the greatest benefits from a diverse portfolio of resources. The Company will also continue to look for unique opportunities to improve its resource portfolio, which may include bringing additional projects of extraordinary advantage before the Commission in compliance with the Commission’s Rules. However, the best place to consider the addition of resources, including new out-of-state wind opportunities, is through the upcoming 2016 IRP.

Georgia’s climate and environment is not conducive to significant domestic generation of wind resources. Therefore, procuring additional wind resources for Georgia means importing energy into the Southern Balancing Authority and into the Georgia Power Electric System. There is a finite amount of intermittent resources that the Georgia Power Electric System can absorb without incurring significant operational costs. While Georgia Power shares in the belief that wind energy has the potential to provide significant value to its customers, Georgia Power customers only realize that value when the benefits exceed the total cost of importing wind energy across multiple states. It makes no economic sense to focus solely on the purchase of out-of-state renewable energy without considering economic and reliable in-state alternatives. The Commission will need to decide whether it is in the customers’ best interest to pay for more in-state renewable resources, like solar, or pay for more out-of-state renewable resources, like wind. More importantly, the Commission will need to decide what additional resources are required, if anything, to serve the needs of Georgia Power’s customers in a reliable and cost-effective manner. These are all appropriate considerations and questions to be asked and answered through the IRP process. There is no evidentiary record proving it is more advantageous and cost-effective to issue an RFP now for out-of-state resources that have inherent transmission risk and operational costs, rather than wait until a more complete resource generation and procurement analysis is in evidence in the 2016 IRP.

There's more, but I will stop with Georgia Power here. Read the documents in the links above for more.

So, what about Entergy? Arkansas Sierra Club Director, Glen Hooks, effectively stuck his foot straight in his mouth in a recent article in the Arkansas Times by regurgitating the following line Skelly likes to use to try to convince people Entergy is actually interested in purchasing electricity from them:

"Entergy recently did an RFP for wind and reopened it because the price was so good they wanted to buy more," Hooks said.Entergy took very little time to correct Hooks' error:

CORRECTION: Entergy Arkansas spokesperson Sally Graham said that Entergy did not reopen its renewable energy bidding, as Hooks stated. She said that Entergy has selected the Stuttgart 81 MW solar project.You'd think the Arkansas Sierra Club would have learned by now that supporting Clean Line is a bad position to hold, wouldn't you? We've been trying to tell them for over a year now.

If you've made it this far, I appreciate it. This is a very complex subject, and understanding that complexity requires countless hours of research and reading between the lines. One finding leads to another, until you've got so many browser tabs open you don't even know where you started. It's really easy to dismiss opposition as NIMBY until you start realizing just how complex and uncertain this whole thing is. Makes you think more than twice about this inexperienced private company obtaining the right of eminent domain to seize over 17,000 acres of land across two full states, doesn't it?

My takeaway:

- The Plains and Eastern is not feasible without the TVA on board. Clean Line has been relying on TVA for almost 6 years to be its anchor. Their plan all along has been to get TVA to agree to purchase enough of a chunk of their capacity to prove that the transmission line is financially feasible enough to gain a regulatory approval from the DOE. All indications point to this not happening for at least ten years, but more than likely fifteen.

- Clean Line has no subscription, and will not have any at all unless DOE approves this boondoggle. But, as I have shown you above, according to DOE's own readily available documentation, a partnership is not allowed without "a sufficient (unknown) percentage of its line subscribed to support the Project's financial viability".

Which begs the question: What utility in their right mind would sign onto a firm contract with these guys? Utilities have to provide reliable and cost-effective power. Clean Line has not demonstrated in any way that they can provide reliable and cost effective power, and there is no utility that is going to agree to a firm service agreement with them without ALL regulatory approvals.

Is the Department of Energy willing to stick its neck out that far for a project that has no demonstrated need? We're not sure, but we're watching.